what is maryland earned income credit

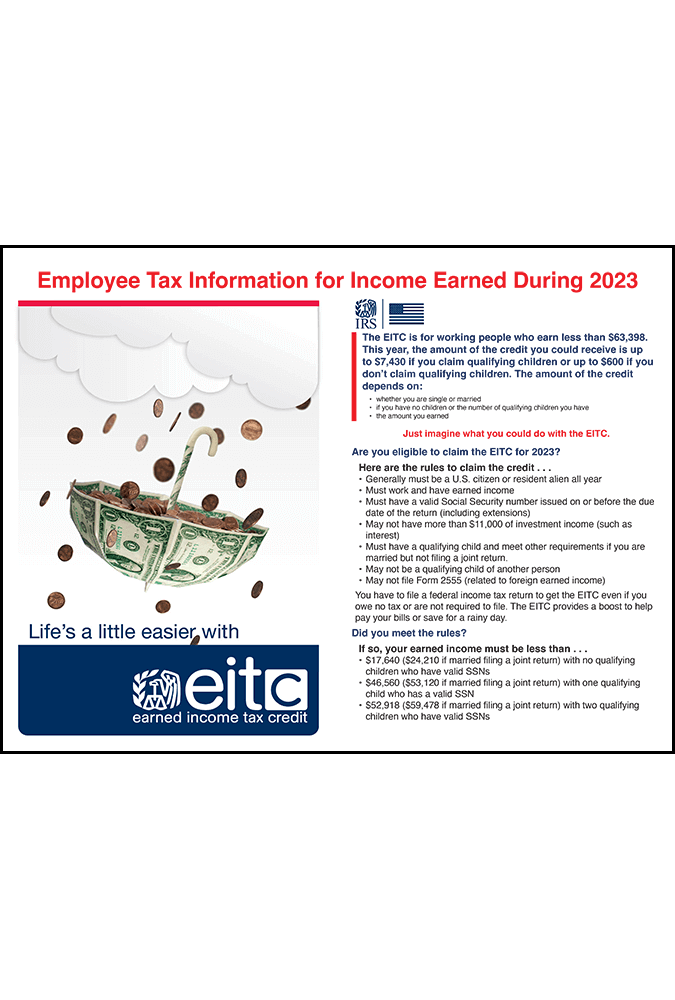

All fields are required. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break.

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021.

. R allowed the bill to take effect without his signature. Earned Income Credit - EIC. An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov.

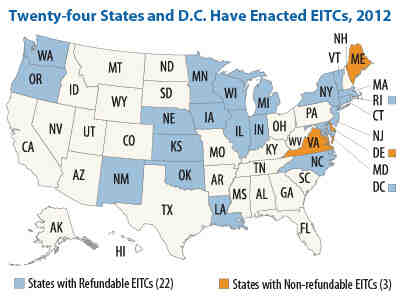

Updated on 4152021 to include changes for Relief Act 2021. 33 rows States and Local Governments with Earned Income Tax Credit States and Local Governments with Earned Income Tax Credit More In Credits Deductions. Answer a few quick questions about yourself to see if you qualify.

Citizen or resident alien for the entire tax year. The earned income tax credit EITC is a refundable tax credit designed to provide relief for low-to-moderate-income working people. Earned Income Tax Credit The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income.

If you claimed an earned income credit on your federal. Earned Income Credit EIC is a tax credit in the United States which benefits certain taxpayers who have low incomes from work in a particular tax. Have a valid Social.

The RELIEF Act also enhances the Earned Income Tax Credit for these same 400000 Marylanders by an estimated 478 million over the next three tax years. The Earned Income Tax Credit also called the EITC is a benefit for working people with low-to-moderate income. To qualify for and claim the Earned Income Credit you must.

What is the Earned Income Credit. The program is administered by the Internal. See Marylands EITC information page.

The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. Eligibility and credit amount depends on your income. In 2019 25 million taxpayers received about.

In May 2018 Maryland passed legislation to eliminate the minimum age requirement for the state. 2021 EARNED INCOME CREDIT EIC Tax-General Article 10-913 requires an employer to provide on or before December 31 2021 electronic. It is a special program for low and moderate-income persons who have been employed in the last tax year.

It is different from a tax deduction which reduces the amount of. IFile 2020 - Help. Select the tax year you would like to check your EITC eligibility for.

If you qualify for the federal earned income tax credit and. Have been a US. The maximum federal credit is 6728.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. If you qualify you can use the credit to reduce the taxes you owe.

State Earned Income Tax Credits 2008 Legislative Update Center On Budget And Policy Priorities

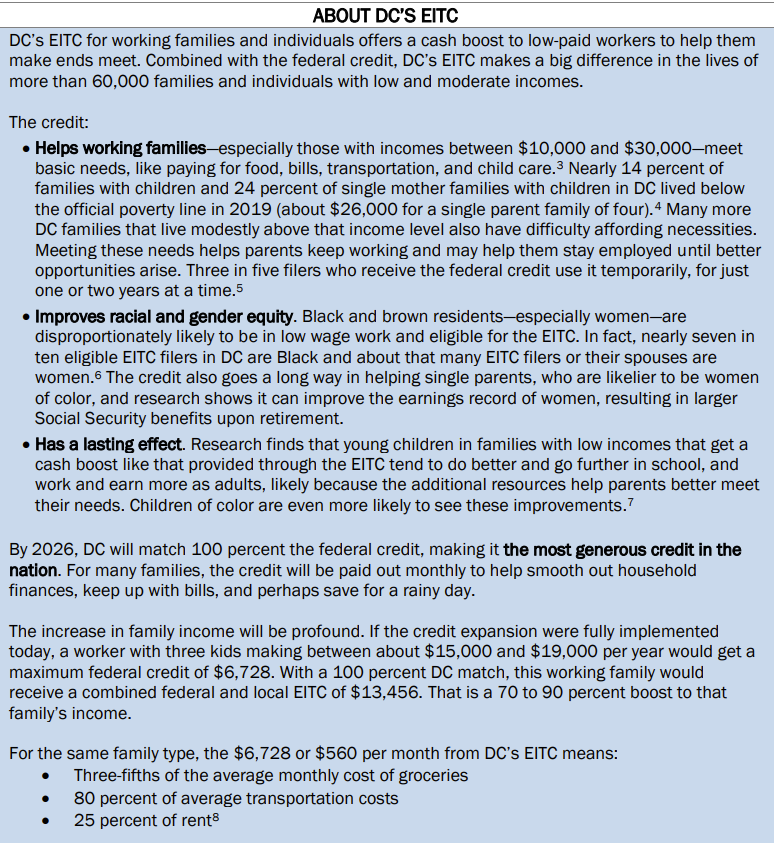

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

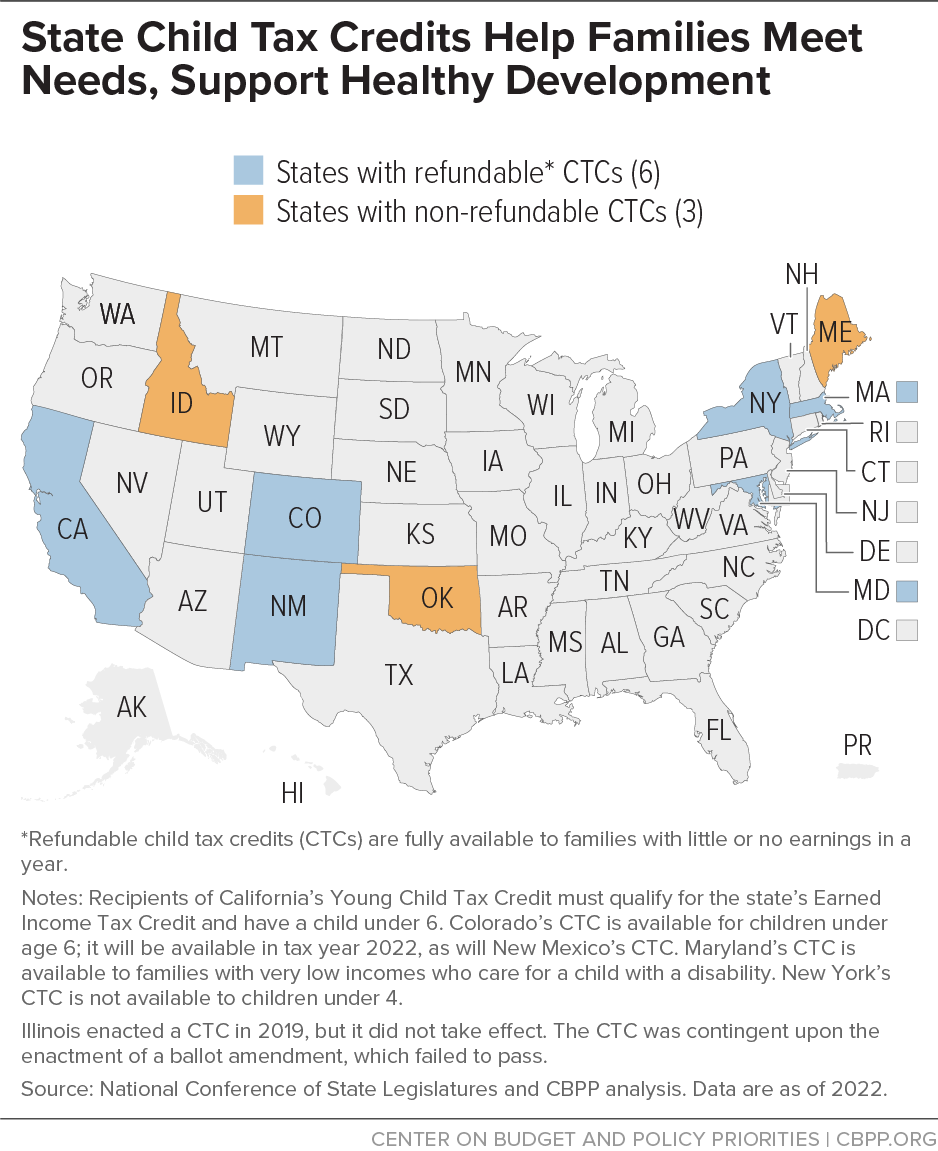

States Should Create And Expand Child Tax Credits Center On Budget And Policy Priorities

How Do State Earned Income Tax Credits Work Tax Policy Center

Irs Earned Income Tax Credit Wall Chart Compliance Poster Company

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Earned Income Tax Credit Eitc Tax Credit Amounts Limits

How To Get Up To 3 600 Per Child In Tax Credit Ktla

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Earned Income Tax Credit Now Available To Seniors Without Dependents

More And More Start Up Swipe 100 Reliable Profit Is Sent Daily Happy Wednesday Nbsp Nbsp Antiminers9 Nbsp Nbsp Nbsp Nbsp Bit

An Orange County Shareholder Disputes Lawyer Can Provide Assistance In Situations Where Co Own Funny Marriage Advice Marriage Advice Cards Best Marriage Advice

How Older Adults Can Benefit From The Earned Income Tax Credit

Summary Of Eitc Letters Notices H R Block

Pin On Villages Of Urbana Homes For Sale

Earned Income Tax Credit Who Qualifies Changes For 2022

Why Is There No Child Tax Credit Check This Month Wusa9 Com

What You Need To Know About The Mortgage Process Infographic Mortgage Infographic Mortgage Process Mortgage Loans